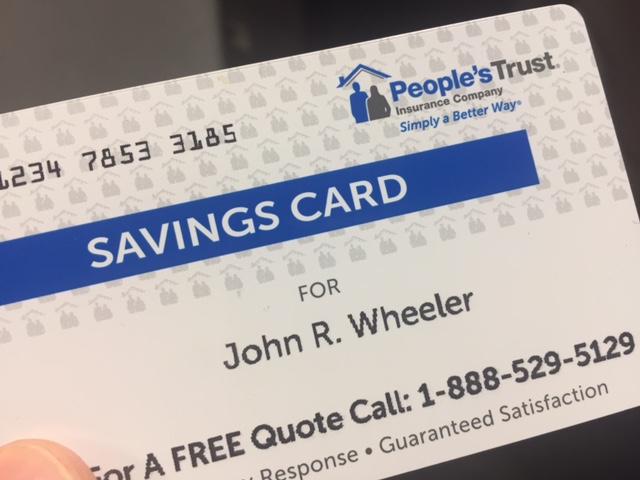

Some of you might receive a mailer promising 30-50% savings on your homeowner insurance like I did last weekend. The promise of savings caught my eye, so I took a close look. I wanted to find out exactly how this company could save me 30-50%.

Marketing Claim #1 – “Basic Choice satisfies most mortgage requirements, but you don’t have to pay for coverages you may never use.”

- Our response – According to the People’s Trust website, The Basic Choice policy excludes water damage, vandalism, theft and sinkhole. With water damage loss the most frequently reported claim in Florida, we wonder why they would promote a policy that excludes such an important coverage.

Marketing Claim #2 – “Our team of experts will explain the policy that covers major perils like fire, smoke, lightning, windstorm, hail, and more. You can add Liability and Personal Property coverage too.”

- Our response – Why would People’s Trust ever sell coverage to a homeowner without liability and personal property coverage? We believe those important coverages should be a part of every home protection plan. Recovery from a catastrophic fire or legal claim is hard enough with adequate insurance. Recovery without these key coverages will surely be many more times difficult.

Marketing Claim #3 – Regarding their Rapid Response Team (RRT) “Our unique, award-winning approach [to claims] gives you access to repair specialists who use top graded materials.”

- Our response – When we read the fine print, we see that homeowner would be required use a contractor of the insurance company’s choosing to make repairs following a claim. We disagree with this approach. We believe homeowners should remain in control of their money and the contractor who repairs their home.

Conclusion – To most of us, our home is our most valuable tangible possession in life, and accordingly, it should be protected against catastrophic losses by the broadest insurance available from a financially strong and trustworthy insurance company. Marketing practices that seek to encourage homeowners to purchase “bare bones” coverage is irresponsible. In this case, the savings does not appear to be worth the sacrifice.