Why is Uninsured Motorist important? More than 1 in 4 drivers in Florida are uninsured and many more have state minimum liability limits. This means that if you sustain a serious injury in an auto accident that is caused by an uninsured driver, you must rely on your own Personal Injury Protection (PIP) and Uninsured Motorist insurance to pay your medical bills. Unfortunately, $10,000 is the maximum available through PIP and may not be enough for accidents involving serious injury.

What does it pay? When you have Uninsured Motorist on your policy, your insurance company will “stand in the shoes” of the at-fault driver who caused your injuries. Whatever you would have claimed against the at-fault driver who caused your injuries, you can legally claim against your own Uninsured Motorist coverage, including medical bills, lost wages, in-home care, pain & suffering, and so on. Benefits available through PIP and may not be enough for accidents involving serious injury.

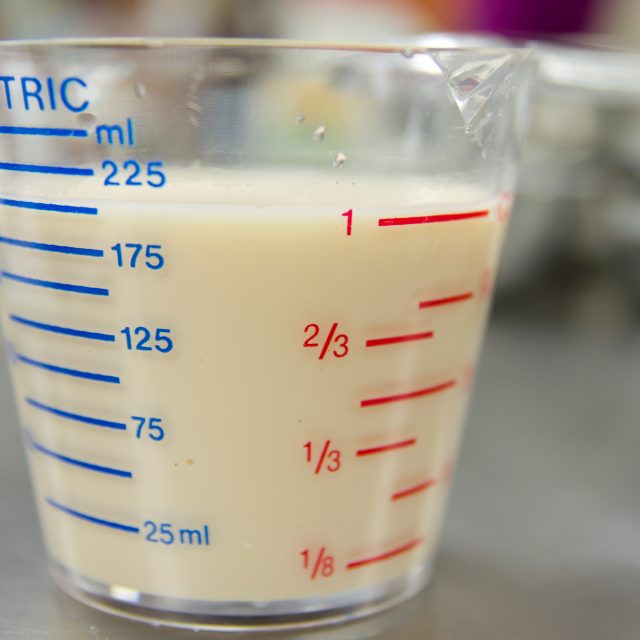

What is stacked coverage? Like a pile of buttermilk pancakes, stacked uninsured motorist allows you to “stack up” your coverage limits according to the number of vehicles you own. For example, if you insure three vehicles with a $100,000 / $300,000 limit, you can add the limits of each vehicle together for an effective amount of Uninsured Motorist of $300,000 / $600,000.

How much is enough? We recommend an amount at least equal to your bodily injury liability limit. Some say, “I don’t need uninsured motorist because I have good health insurance.” We agree that you do not need to duplicate coverage, but remember, uninsured motorist pays for financial losses in addition to medical bills. Loss of wages, in-home care and pain & suffering are generally not paid for by health insurance. There is no exact answer to this question as each family’s financial situation is different. Some uninsured motorist is better than none. Stacked uninsured motorist coverage is better than non-stacked.

How can I learn more? Call us at (386) 752-8660. We will take our time to answer all of your questions. Our job is to help you understand your coverage.